Rttoys

Goblin Guru

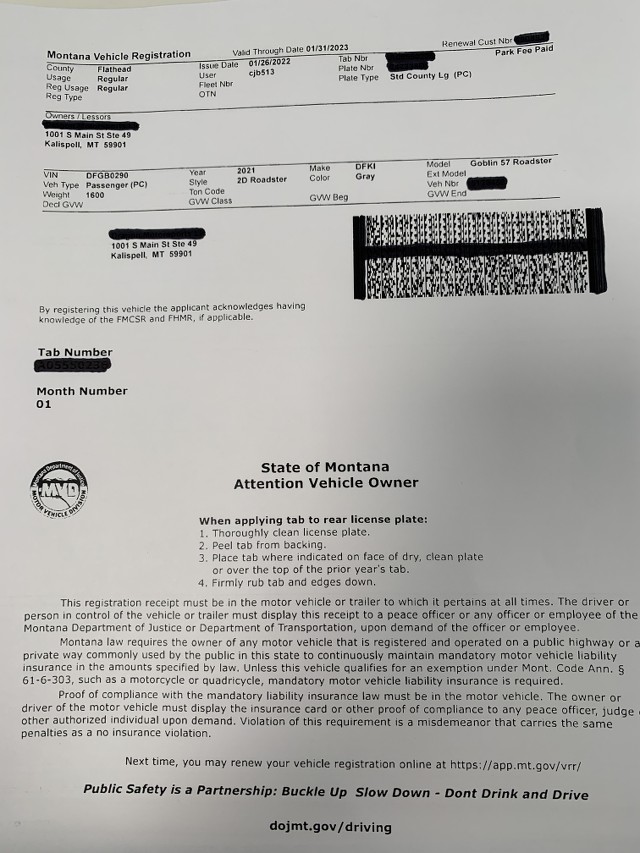

A lot of it will depend on where you live and power to weight ratios. Allstate, progressive and hagerty wouldn’t touch mine. When they asked how much it weighed, engine and horsepower (I even said a much lower hp than it has) they declined quickly. Well, hagerty took my money then canceled my policy a day later, then I had to ask for my money back.